Your settlements

Saal Photo Portal does not charge any commission on the sale of your photo products. This means the profit from selling your products goes entirely to you; only digital downloads are subject to a small service fee.

Sample calculation

For example, if the cost of a product is €100 and you decide to set a profit of 30%, the selling price will be €130 and your profit will be €30. No fee is applied by Photo Portal.

Selling price: €130

Cost of a product: €100

Your Gross Profit: €30

Saal Digital Professional Account:

In addition, if you decide to upgrade your account to a Saal Digital Professional Account, you will receive a 35% discount on all products. Continuing with the previous example, if the cost of a product is €100 and you set a profit of 35%, leaving a selling price of €130, your earnings will be €65. This is €30 of the chosen profit and €35 representing the 35% discount from your Saal Digital Professional Account.

Selling price: €130

Cost of a product: €65

Your gross profit: €65

Payout

The date on which the amount of your earnings will be credited to your payout account can be found in Your Settlements section, within the Sales panel. There you will also find all the detailed information about your earnings, grouped by month.

You will find an overview for each month and can download the credit directly.

The profit will be credited to the payout method that you have specified in the Payment method section within Accounts.

Small business regulation

Small businesses can also use our portal on a regular basis. In all cases, Saal Digital issues the invoice. As a small business owner, you will receive your profit and do not have to issue an invoice yourself. If you are a small business or operate under any other business model where VAT does not apply, please contact our Photo Portal customer support and let us know your status. This way, we can ensure that the self-billed invoices generated for your payouts are issued without VAT.

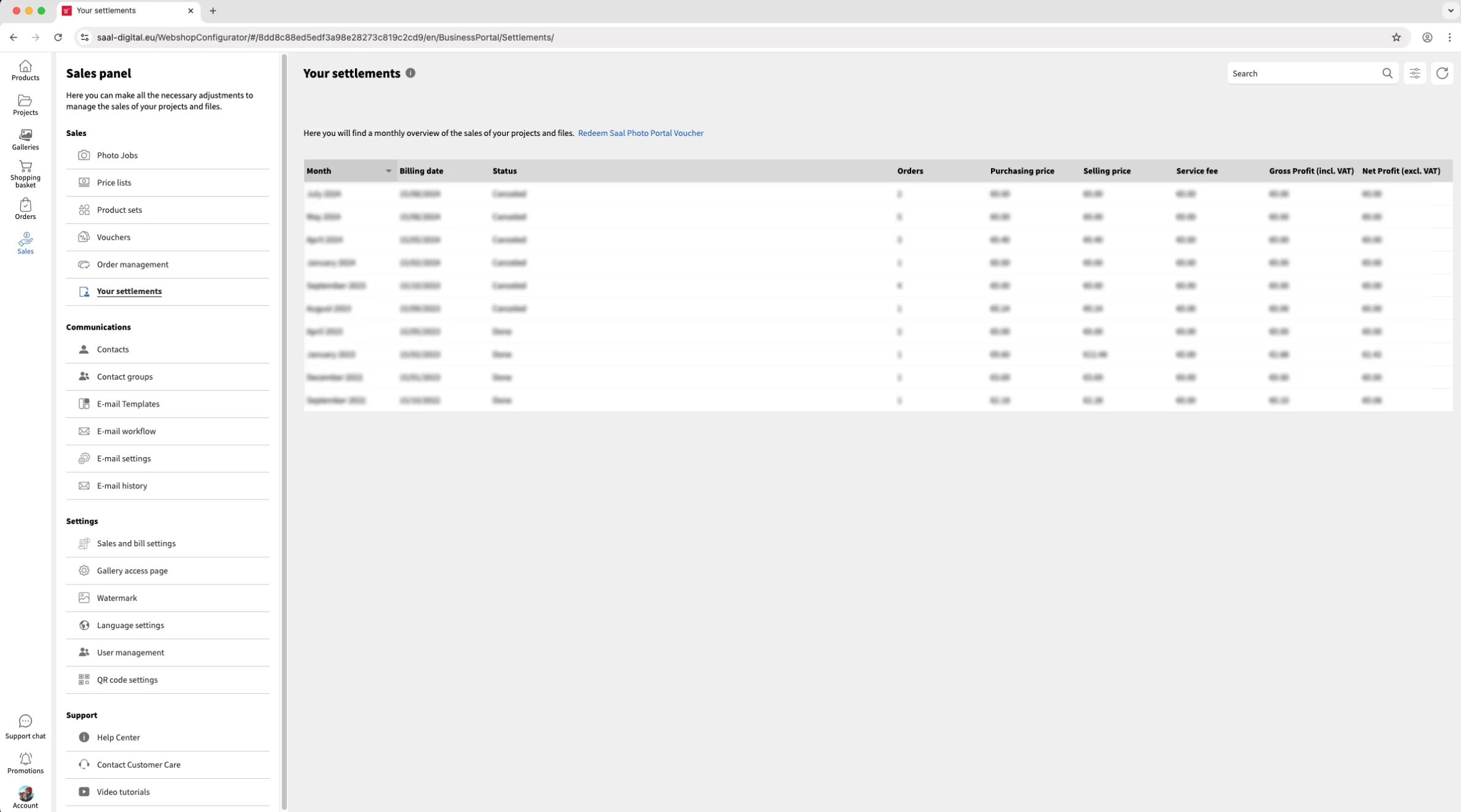

Your settlements menu

This menu gives you access to a monthly overview of your project and image sales. You can watch the Order Management and Reportings video tutorial for a brief overview, or read on for the full guide.

The settlement information is displayed as follows:

Month: Indicates the month to which the information corresponds.

Billing date: Displays the date when your earnings were credited to your payout account.

Status: Shows the current status of the settlement month.

Orders: Provides the total number of orders processed within the settlement period.

Purchasing price: Represents the total purchase price for all orders placed within the settlement period.

Selling price: Displays the total selling price for all orders placed within the settlement period.

Service fee: Indicates the commission deducted by Saal Photo Portal from the sales during the settlement period.

Gross Profit (incl. VAT): Displays the profit earned during the settlement period, including VAT.

Net Profit (excl. VAT): Displays the profit earned during the settlement period after VAT has been deducted.

You can sort the information in ascending or descending order by clicking on any of the table headers.

In the top right corner, you’ll find several useful tools:

Search: Use this box to search for a specific settlement by entering relevant information.

Filter: Click this button to display various filter options, allowing you to filter the information by date.

Refresh: This button refreshes the information displayed here.

To view the details of a particular settlement, click on it. Within each monthly settlement, you can access detailed information on all orders placed during that period.

Download credit note

You can download a PDF containing all the settlement details for each month. Note that this option will only be available after the month has concluded.

In the Settlement menu, select the month for which you want to download the Credit Note. In the right column, you will find the Download credit note button. Click this button to download the Credit Note for the selected month.

For EU countries and Switzerland, Saal Digital issues self-billed invoices/credit notes for all payouts generated through the portal. These documents are created under the self-billing procedure in accordance with EU Directive 2010/45/EU.

- Germany (DE) and Switzerland (CH): Payouts for profits generated through the portal are usually paid out in gross by default. In these cases, the self-billed invoice/credit note shows the gross profit, including VAT if applicable.

- All EU countries except Germany: Payouts are issued in net amounts, as the VAT liability shifts to the recipient under the reverse-charge mechanism. This means the self-billed invoice/credit note in these countries will not include VAT, and we as the recipient are responsible for declaring the VAT in our country.

Should you have any questions about your credit notes or how VAT is handled in your country, please contact our Photo Portal customer support.

For a complete overview of Saal Photo Portal, watch our full Photo Portal Setup Walkthroughs tutorials.